Toluene Diisocyanate (TDI) Market to Reach USD 2.67 Billion by 2032 Forecasted Growth Driven by Industrial Demand

The ongoing advancements in PU formulation & strategic investments in construction & industrial coatings will increase global demand for Toluene Diisocyanate.

An increase in the application of flexible polyurethane foams in the manufacturing of furniture, bedding, and seating for the automotive industry provides ongoing momentum for the global TDI market.”

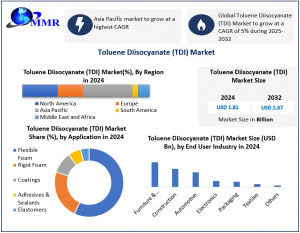

WILMINGTON, DE, UNITED STATES, November 10, 2025 /EINPresswire.com/ -- Global Toluene Diisocyanate (TDI) Market size was valued at USD 1.81 Bn in 2024 and is expected to reach USD 2.67 Bn by 2032 at a CAGR of 5%. Asia Pacific remains the largest and fastest-growing region, supported by booming furniture, bedding, automotive, packaging, and construction sectors.— Dharti Raut

Toluene Diisocyanate (TDI) Market Overview

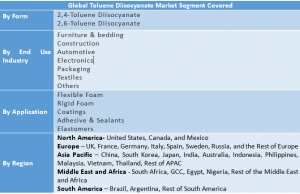

Toluene Diisocyanate (TDI) is an aromatic isocyanate made from toluene, phosgene, chlorobenzene, and xylene, and manufacturers use its two main types, 2,4-TDI and 2,6-TDI, to manufacture polyurethane products. Industries count on TDI to produce flexible foams used in furniture, bedding, automotive seating, and as a carpet underlay, and have the potential for use in coatings, adhesives, sealants, and elastomers. Global consumption and demand for TDI will increase, along with demand for TDI in polyurethane products. The Asia Pacific region is leading in TDI demand because of manufacturing efforts to increase production, urbanization, greater production of furniture, and increased demand. Environmental issues and enhanced regulations of handling limitations will continue to have an influence on production costs and supply.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/42497/

Global Toluene Diisocyanate (TDI) Market Dynamics

Growth Driven by Increasing Demand for Flexible PU Foams in Furniture, Bedding, and Automotive

Consumption of TDI is closely related to the strong demand for flexible polyurethane-based foams, which are lightweight, comfortable, durable, and highly moldable. Furniture and bedding applications represent the largest share of TDI demand, as trends related to increased urbanization and home renovations, as well as new ready-to-assemble furniture manufacturing, define demand for flexible poly foams.

Driver for automobile seat cushioning is also significant as the production of luxury and mid-tier vehicles continues to grow, along with the resulting competition among OEMs to improve comfort and durability.

Continued expanding use of PU in coatings, sealants, and packaging

TDI is experiencing significant adoption in coatings and adhesive applications due to the favorable chemical bonding and performance characteristics of TDI. The demand for sealants in infrastructure, construction, and automotive aftermarket applications is also creating demand for TDI. The trend of packaging toward more lightweight materials also grows TDI demand in rigid PU foams.

Global Toluene Diisocyanate (TDI) Market Opportunities

Growth Potential from the Expanding Furniture and Automotive Manufacturing Base in the Asia Pacific

Asia Pacific represents a strong opportunity for TDI suppliers as it grows its furniture-producing ecosystem. Countries such as China, India, Vietnam, and Indonesia are expanding their production of mattresses, upholstered products, and wood-based products, which utilize flexible PU foams. In addition, growing automotive manufacturing in India, Thailand, South Korea, and China continues to generate new pockets of demand for PU seating and interior cushioning.

Increased Penetration of PU in Construction and Energy Efficient Insulation

Construction activities in developing regions are creating opportunities for increased demand for PU-based insulation, coatings, and sealants. TDI-based elastomers and adhesives are expected to expand into flooring, waterproofing membranes, and industrial coatings as global demand for energy-efficient building products continues to grow.

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/42497/

Global Toluene Diisocyanate (TDI) Market Challenges

Environmental and Regulatory Constraints Concerning Isocyanates

TDI handling entails strict compliance with regulations due to its toxicity and environmental hazards, including money spent on emission control regulations, worker regulation and safety, and disposal regulations, which raise a manufacturer's operating costs. These regulations may slow the production expansion and diminish access to new entrants into the industry.

Price Fluctuation and Supply Disruption

TDI is susceptible to raw material availability, issues within the global supply chain, or maintenance shutdowns at major production facilities. Price variations could stem from unexpected plant outages or shutdowns, geopolitical issues, or limited phosgene responsiveness, contributing to supply shortages and price volatility.

Global Toluene Diisocyanate (TDI) Market Segmentation

Based on the application category, flexible foam holds the maximum share of the market in 2024. The flexible foam segment is witnessing rapid growth due to increased consumer demand for bedding and comfort products (such as mattresses and sofas) as well as larger automotive seating. Furthermore, flexible foam, through a continuous production capacity strategy, will dominate in all product crevices within comfort products suited for consumers.

The form category is made up of two chemicals – 2,4-Toluene diisocyanate (2,4-TDI) and 2,6-Toluene diisocyanate (2,6-TDI), and the 2,4-TDI segment is expected to dominate the market space through 2024. The 2,4-TDI market accounted for approximately 80 percent of commercial TDI mixtures used for the production of flexible polyurethane foam in 2024. From a chemical perspective, 2,4-TDI offers the ideal reactivity and cost to accommodate product application needs.

Global Toluene Diisocyanate (TDI) Market Regional Insight

In 2024, the Asia Pacific region played a leading role in the market and will continue to lead the market until 2032. China, India, and Southeast Asia have significant manufacturing bases for furniture, bedding, automotive, and construction, which will generate ongoing and strong downstream demand for flexible and rigid polyurethane foams. Urban population growth, home renovations, and expanding export manufacturing will also support strong market growth. North America and Europe will remain strong demand regions, due to high automotive production, particularly in these two locations, where the construction industry is mature and PU-based products are widely adopted. The Middle East, Africa, and South America are also emerging markets as consumption continues to rise in furniture, insulation, and industrial coatings.

Global Toluene Diisocyanate (TDI) Market Competitive Landscape

The market is highly competitive with several multinational manufacturers and regional producers. Major companies include:

• Tosoh Corporation

• BASF SE

• The Dow Chemical Company

• LANXESS

• Covestro AG

• Mitsui Chemicals Inc.

• China National Bluestar Group

• Anderson Development

• Bayer MaterialScience LLC

• Huntsman Corporation

• Others

Recent strategic developments include expansions in production capacity, mergers, long-term supply agreements, and technological upgrades to minimize emissions and improve process safety across facilities.

FAQs – Toluene Diisocyanate (TDI) Market

What was the size of the global TDI market in 2024?

In 2024, the global TDI market was valued at USD 1.81 billion due to the increase in production of polyurethane foams for furniture, automotive, and bedding applications.

Which region dominated the TDI market?

Asia Pacific dominated the TDI market due to the expansion of polyurethane production by manufacturers and industries, increasing their consumption of flexible foam in construction and automotive applications.

Which form segment held the largest share in 2024?

The 2,4-TDI segment accounted for the largest share in 2024 due to producers utilizing it in almost 80 percent of commercial TDI blends for the manufacture of flexible polyurethane foam.

What is the forecasted growth rate for the market from 2025 to 2032?

The market is expected to grow at an estimated CAGR of approximately 5 % from 2025 to 2032 due to an increase in demand for foams and coatings in essential industries.

Which applications are driving the TDI market growth?

Flexible foam, rigid foam, coatings, adhesives and sealants, and elastomers drive the growth of the market, with flexible polyurethane foam being the largest contributor to global demand.

Related Reports:

Fluorotelomers Market https://www.maximizemarketresearch.com/market-report/global-fluorotelomers-market/24992/

Antimony Market https://www.maximizemarketresearch.com/market-report/global-antimony-market/25745/

About Us

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

Lumawant Godage

MAXIMIZE MARKET RESEARCH PVT. LTD.

+ +91 96073 65656

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.